Building tax capacity in Africa: A successful international partnership

by ATAF and TIWB Secretariats

22 April 2021

|

Many African countries struggle to collect revenues necessary to provide basic services to their citizens – an issue that severely hinders development and prosperity in the region. It is crucial for countries in the African region to mobilise domestic revenues in a fair and efficient manner, with the key aim of financing investments in human capital, citizens’ health and infrastructure. Besides constituting a critical source for development, increased tax revenue collection is key for the achievement of the Sustainable Development Goals by 2030. Low tax collections in African countries often indicate weak revenue management systems, causing many countries to miss opportunities to mobilise tax revenues. In 2018, the average tax-to-GDP ratio in in Africa (30 countries) was 16.5%, compared to 23.1% in Latin America and the Caribbean (LAC) and 34.3% across the OECD member countries. The figure below shows trends across the three groups from 2000 to 2018.

The Addis Ababa Action Agenda on Financing for Development calls all actors to support developing countries in building their capacities to raise domestic revenues. The Organisation for Economic Co-operation and Development (OECD) is committed to responding to that call, and supporting Africa’s economic development, particularly on domestic resource mobilisation to help the continent achieve the Sustainable Development Goals (SDGs).

In recent years, the OECD has been the centre of rapid progress in tackling tax avoidance, evasion and tax crime, through increased international co-operations combined with more inclusive ways of working : the Inclusive Framework on BEPS is comprised of 139 members from both developed and developing countries, the Global Forum on Transparency and Exchange of Information for Tax Purposes (Global Forum) involves the participation of 162 jurisdictions, and the OECD International Academy for Tax Crime Investigations provides courses around the world. Africa is increasingly engaged, with 25 African governments participating in the Inclusive Framework and 32 government members of the Global Forum.

To support Africa in taking advantage of the new era of tax co-operation, a range of capacity building tools are on offer from the OECD. These include bilateral capacity building programmes, BEPS induction programmes, Global Forum peer reviews and the Africa Initiative, as well as the Kenya Tax Crime Academy. The Revenue Statistics in Africa publication and dataset produces reliable and harmonised revenue statistics for an increasing number of African countries; disseminating and promoting the use of high-quality revenue statistics as evidence to inform policy analysis and decision-making; and increases the African Statistical System’s capacity to produce comparable and harmonised revenue statistics for Africa.

The scale and complexities of the challenges in building effective tax systems in Africa are such that I partnerships between countries, regional and international organisations are fundamental to bring together different knowledge, skills and resources. In this context, the importance of the ongoing collaboration for successful capacity building between the African Tax Administration Forum (ATAF); Tax Inspectors Without Borders (TIWB), and other partners such as the World Bank Group (WBG), cannot be overstated. |

ATAF Technical Assistance team with Angola CG, during Angola TADAT Assessment (May 2019) |

African Tax Administration Forum

ATAF was established by African revenue authorities in the wake of the 2008 financial and economic crisis and of the subsequent fall of foreign aid and foreign direct investment to African countries. In such context, a number of African countries realised the need to decrease their reliance on overseas aid and the need to be in control of the continent’s development themselves, namely through increased capacity in the mobilisation of domestic resources. Therefore, ATAF was formed in 2009 with the goal of improving African tax administrations’ capacity to achieve their revenue objectives, advance the role of taxation in African governance and state building, and establish and support partnerships between African countries and development partners. |

|

Through improved tax systems, ATAF aims to increase African states’ accountability to their citizens, enhance domestic resource mobilisation (DRM) and foster real, inclusive economic growth. ATAF provides technical assistance and capacity building to its members in a variety of tax administration areas. The organisation responds flexibly to member countries’ technical assistance requests, as well as other identified tax policy and administration gaps, in domestic or international tax issues, as well as on DRM, local tax system effectiveness and base erosion and profit shifting (BEPS) issues. To date, ATAF has provided this technical support to multiple countries in this regard and new requests have been received from the ATAF membership.

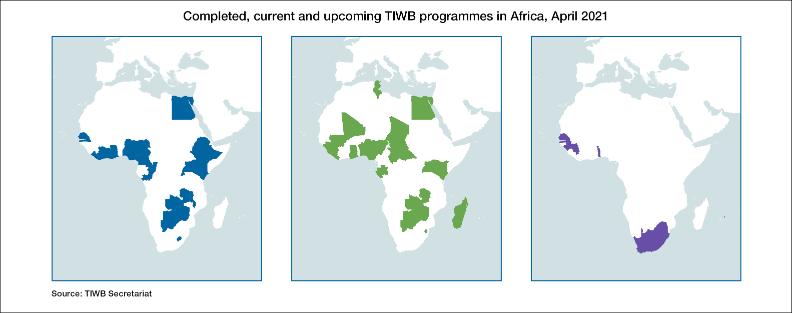

A majority of ATAF member states participate in TIWB programmes either as a partner or host administration. Revenue authorities in Benin, Botswana, Cameroon, Egypt, Eswatini, Gabon, Ghana, Kenya, Lesotho, Liberia, Malawi, Mauritius, Morocco, Nigeria, Rwanda, Senegal, Sierra Leone, South Africa, Uganda, Zambia, and Zimbabwe either benefit from or provide assistance under TIWB programmes. |

|

Tax Inspectors Without Borders

TIWB is a joint initiative by the OECD and the United Nations Development Programme (UNDP), partnering with ATAF in Africa, which facilitates targeted, specialised tax audit assistance in developing countries around the world. TIWB responds to requests for technical and practical tax audit assistance, through a hands-on, learning-by-doing approach to building capacity for tax administrations. TIWB programmes provide a unique approach to transferring knowledge to tax authorities for improving their audit processes.

With programmes across Africa, Asia, Eastern Europe, and Latin America and the Caribbean, the initiative has completed 42 programmes and is operating another 45 programmes globally. Demand remains high for this type of technical assistance. Its niche mandate of working on real audit cases sets TIWB programmes apart from general technical assistance programmes. Capitalising on the important foundations laid by ATAF and other development partners, tax administrations can then apply their knowledge to specific casework under TIWB programmes. |

TIWB eSwatini programme launch |

|

TIWB and ATAF are mutually committed to co-operate on technical assistance on tax for the continent. In particular, ATAF works with its member country tax administrations and deploys its international tax experts for TIWB programmes in Botswana, Eswatini, Ghana, Malawi, Mauritius, Nigeria, Uganda and Zambia. This TIWB-ATAF collaboration builds on ATAF capacity building and technical assistance programmes already provided to its member countries. These ATAF programmes provide long-term technical assistance on a wide range of international tax issues often with a particular focus on transfer pricing. The programmes are demand-led and broad in scope. The technical assistance has significantly increased the knowledge and skills of several hundred African tax officials and helped 11 African countries enact over 30 new pieces of legislation and regulations. It has also assisted countries to form transfer pricing/international tax teams and improve risk assessment processes. This work has provided key building blocks which can be capitalised on by host countries during their TIWB programmes. |

|

|

|

South-South Co-operation Many African tax administrations, based in the same region and/or focussed on audits in specific sectors, face similar challenges. In this context, ATAF has the crucial ability to promote the sharing of expertise and knowledge in the continent through South-South programmes. Through enabling tax officials from neighbouring tax administrations to collaborate, South-South co-operation empowers African host administrations and fosters intra-regional dialogue and development.

In this regard, ATAF played an instrumental role in supporting TIWB’s first South-South co-operation programme in 2016, when experts from the Kenya Revenue Authority (KRA) provided technical assistance for audits of multinational enterprises to counterparts in the Botswana Unified Revenue Service (BURS). Subsequent collaboration between ATAF members took place in 2018 when the South African Revenue Service (SARS) provided two tax officials to implement a TIWB programme on transfer pricing for the Zambia Revenue Authority (ZRA). |

|

ATAF Tax and Development Course with Kenya |

The first South-South programme between two Francophone countries commenced in 2019, when Morocco deployed a tax audit expert to support Cameroon’s tax administration under a TIWB programme. Additional South-South programmes among ATAF member countries include the upcoming TIWB programme in Senegal (supported by Morocco) and current programmes, such as in Ghana (South African officials), Liberia (Nigerian officials) and Zimbabwe (South African officials).

As a prominent regional player, ATAF is in a unique position to identify needs on the ground and foster knowledge sharing of best practices among its members. Local co-operation between members, on real cases, within the framework of TIWB programmes is encouraged.

TIWB programmes are also implemented in collaboration with other regional organisations and partners administrations elsewhere around the globe. |

|

Results for Tax Administrations

ATAF-TIWB co-operation yields excellent value for money. With tax seeing positive results for additional revenue collection, as well as organisational improvements and taxpayer compliance improvements. To date, on the African continent, TIWB assistance, in collaboration with ATAF/OECD/WBG technical assistance programmes, has raised over USD 592 million in additional tax revenues and USD 1.80 billion in tax assessments. Host Administrations also report significant improvements in skills, competencies and confidence of local officials when conducting international tax audits.

Despite the challenges arising due to the COVID-19 pandemic, ATAF and TIWB technical assistance programmes continue and will help host administrations effectively collect the taxes due to them by multinational enterprises (MNEs) operating in their countries, providing tax revenues which will be crucial for African countries to recover from the economic repercussions of the COVID-19 crisis. The increased practical challenges of delivering capacity building during the pandemic make strong regional co-operation between the two organisations particularly important.

The TIWB model’s success has prompted the expansion of the initiative to new tax areas, which include pilot programmes on criminal tax investigations, effective use of automatically exchanged information, taxation and natural resource contracts, as well as joint/simultaneous audits. TIWB programmes can be requested online via a dedicated Assistance Request Form.

ATAF and TIWB are proud to work together to support African tax administrations with their technical assistance needs throughout 2021 and beyond.

More information on TIWB and ATAF can be found on their websites. |

Related Documents